The SIGMAXYZ Group discloses climate change-related information in line with the four thematic areas of the TCFD*: governance, strategy, risk management, and metrics and targets.

We will continue to further promote efforts to address environmental issues, such as climate change, and enhance information disclosure in accordance with the TCFD's recommendations.

*The Task Force on Climate Related Financial Disclosures (TCFD), a task force established by the Financial Stability Council (FSB), released recommendations in June 2017 encouraging companies to understand and disclose the risks and opportunities that climate change presents.

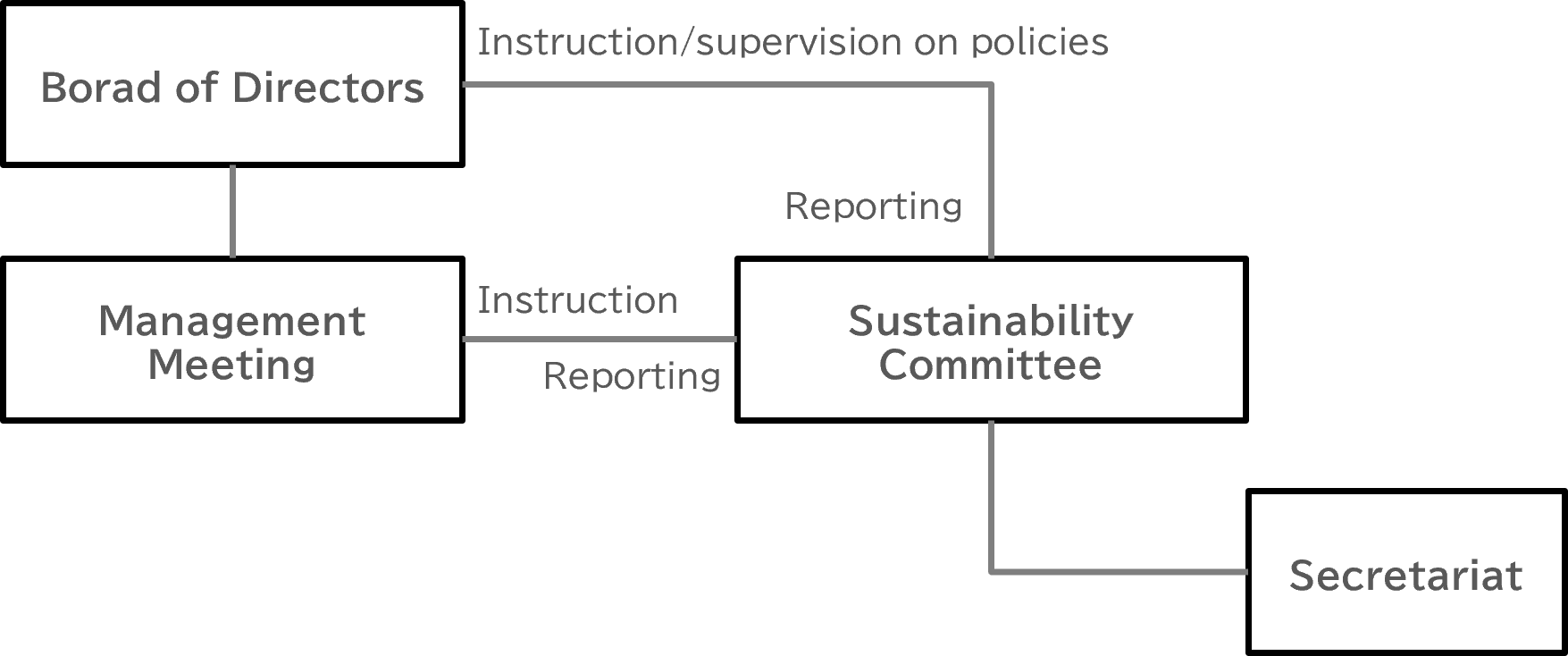

We believe that the value of a company is a synthesis of financial and non-financial value, and established a Sustainability Committee in October 2021 that places importance on Sustainable Development Goals (SDGs) and Environmental, Social and Governance (ESG) factors in promoting our business. We are strengthening our commitment to ESG and SDGs by examining the effects on climate change and environmental issues, and by monitoring risks and regularly reporting to the Board of Directors.

- The Sustainability Committee is chaired by the Directors who execute operations and comprises Executive Officers responsible for their respective business segments. It also operates from the perspective of the three ESG elements: "Environment," "Social," and "Governance."

- Important issues related to sustainability initiatives are deliberated by the Management Meeting, and reported and supervised by the Board of Directors.

- The Sustainability Committee is regularly convened to discuss initiatives to address issues surrounding sustainability. The Committee also examines measures to tackle sustainability issues and monitors progress thereof.

Sustainability Committee

The SIGMAXYZ Group aims to create a sustainable and beautiful society by actively participating in the green transformation (the achievement of a decarbonized society by 2050) through educational and dissemination activities to companies and industries and fostering "aggregator" human assets, while also supporting advanced products and services that contribute to the improvement of the global environment through our clients, partnerships, and communities.

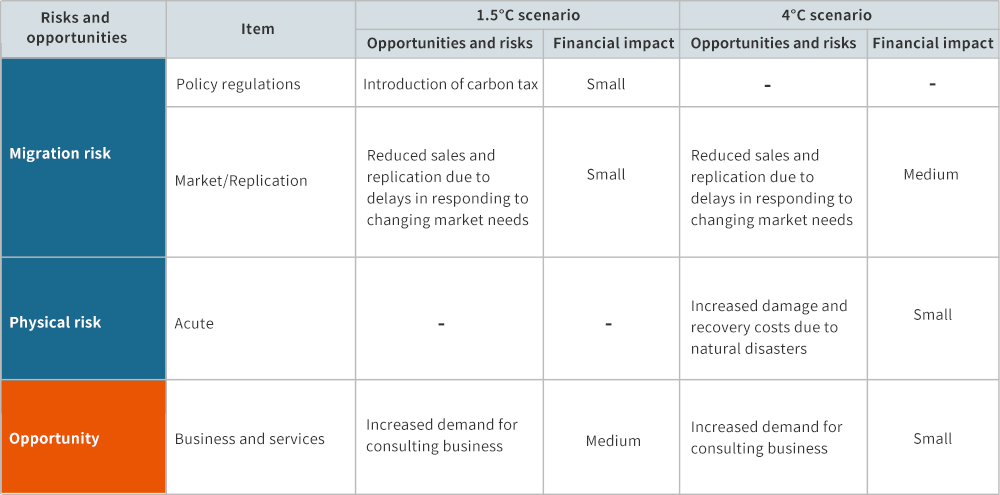

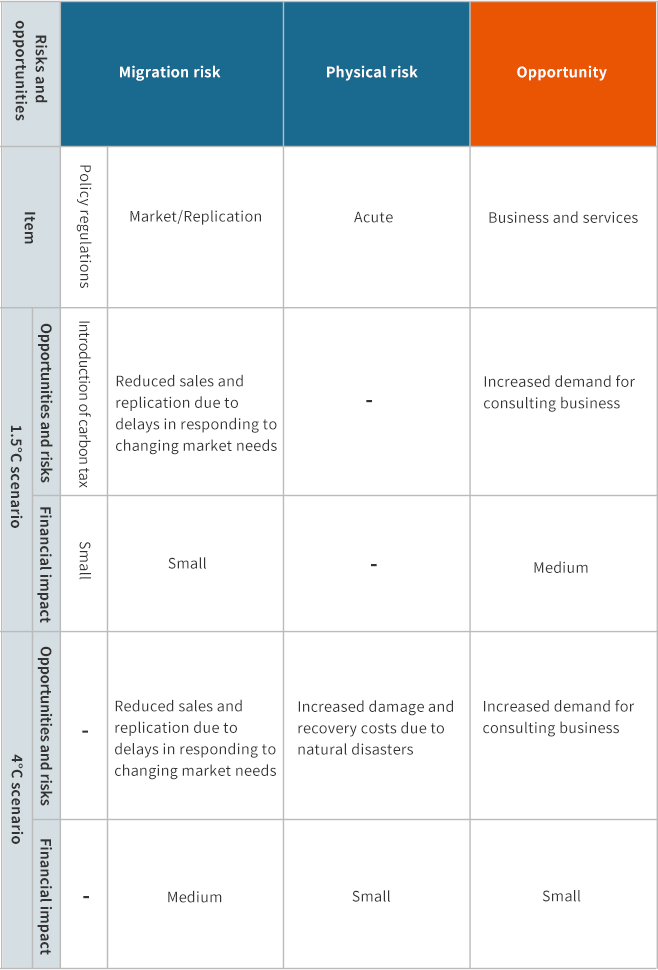

Scenario analysis was conducted for consulting, our core business.

As for the main opportunity, we are expecting increased demand for consulting assistance for transitioning to a decarbonized society and adapting to climate change.

On the other hand, the risks include negative effects that could be incurred by the introduction of carbon pricing (such as a carbon tax) and macroeconomic stagnation that comes with a large-scale disaster caused by climate change.

The Paris Agreement seeks to keep the global average temperature from rising more than 2°C compared to before the Industrial Revolution and keep it to 1.5°C. The financial impact in 2030 was analyzed based on the 1.5°C scenario, indicating a carbon neutral world in 2050, and the 4°C scenario, where large-scale natural disasters often occur.

* The IPCC 1.5°C Special Report (SR15), IEA WEO NZE2050, etc. were referenced for the 1.5°C scenario and the IPCC RCP8.5, etc. were referenced for the 4°C scenario.

Climate-related risks, opportunities, and financial impacts are as follows:

|

Financial impact: The financial impact ratio is classified with operating profit for 2030 set to 100 |

||

|

Large |

30% or more |

A significant effect on business strategy or financial impact is expected |

|

Medium |

5% to less than 30% |

A moderate effect on business strategy or financial impact is expected |

|

Small |

Less than 5% |

A small effect on business strategy or financial impact is expected |

- The financial impact of reduced orders due to natural disasters, etc., was analyzed based on past examples

・Past financial impact: (FY2019 vs. FY2020 Operating Profit Change Rate - 20%) expected decline in business operations - Responding to corporate sustainability issues is considered an opportunity for the consulting business, and the financial impact is analyzed in anticipation of increased demand

Regarding climate related risks, the Environmental Subcommittee of the Sustainability Committee is considering responses to the risks associated with the transition to a decarbonized society, greenhouse gas emissions reduction, and the physical effects of climate change.

In assessing climate-related risks, the SIGMAXYZ Group has set the following targets for greenhouse gas emissions:

|

Scope 1 and 2: |

Fiscal year ended March 31, 2031 “50% reduction from fiscal year ended March 31, 2022” Fiscal year ended March 31, 2051 “Net zero emissions” |

|

Scope 3: |

In the future, we will strive to refine the aggregate and work toward setting goals. |

|

KPI |

Results for fiscal year ended March 31, 2022 |

Results for fiscal year ended March 31, 2023 |

Results for fiscal year ended March 31, 2024 |

Results for fiscal year ended March 31, 2025 |

Target for fiscal year ended March 31, 2031 |

Target for fiscal year ended March 31, 2051 |

|

Scope 1, 2 tCO2e |

148.57t |

127.91t |

61.09t |

26.79t |

Compared to fiscal year ended March 31, 2022 |

Net zero emissions |

(Note 1) Scope 1: direct emissions of greenhouse gases by the business operator / Scope 2: indirect emissions due to the use of electricity, heat, or steam supplied by other companies / Scope 3: other indirect emissions that don't fall under Scope 1 or 2 (emissions by other companies related to the activities of the business operator)

(Note 2) The reduction plans and measures related to GHG emission are expected to be flexibly changed according to progress in technological development, economics, and policy/institutional support.