(As of May 8, 2025)

Basic Policy

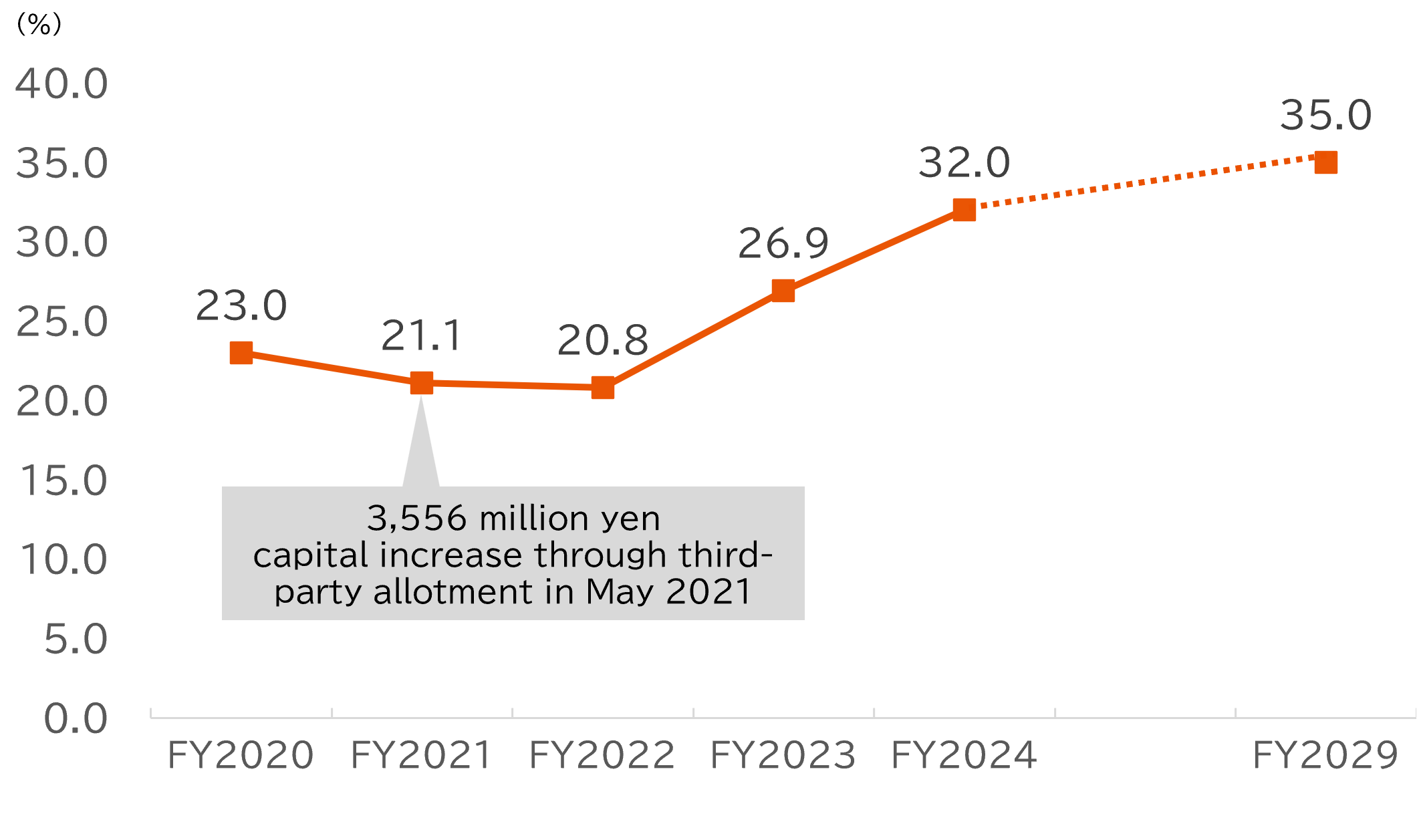

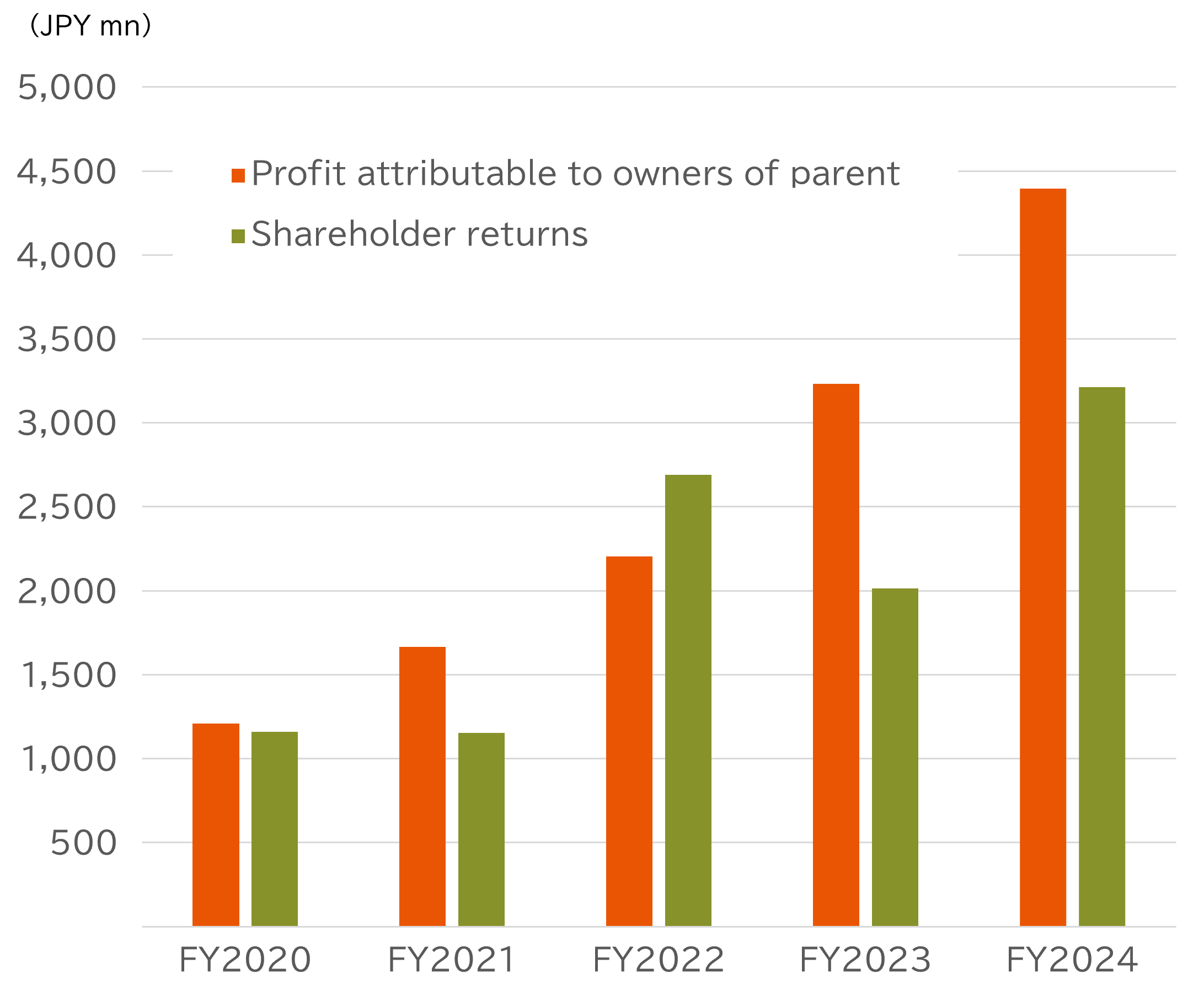

In order to continually carry out a balanced return of value to employees, shareholders, and society, we will invest in medium- and long-term sustained growth, and maintain an appropriate level of shareholder equity that enables risk tolerance.

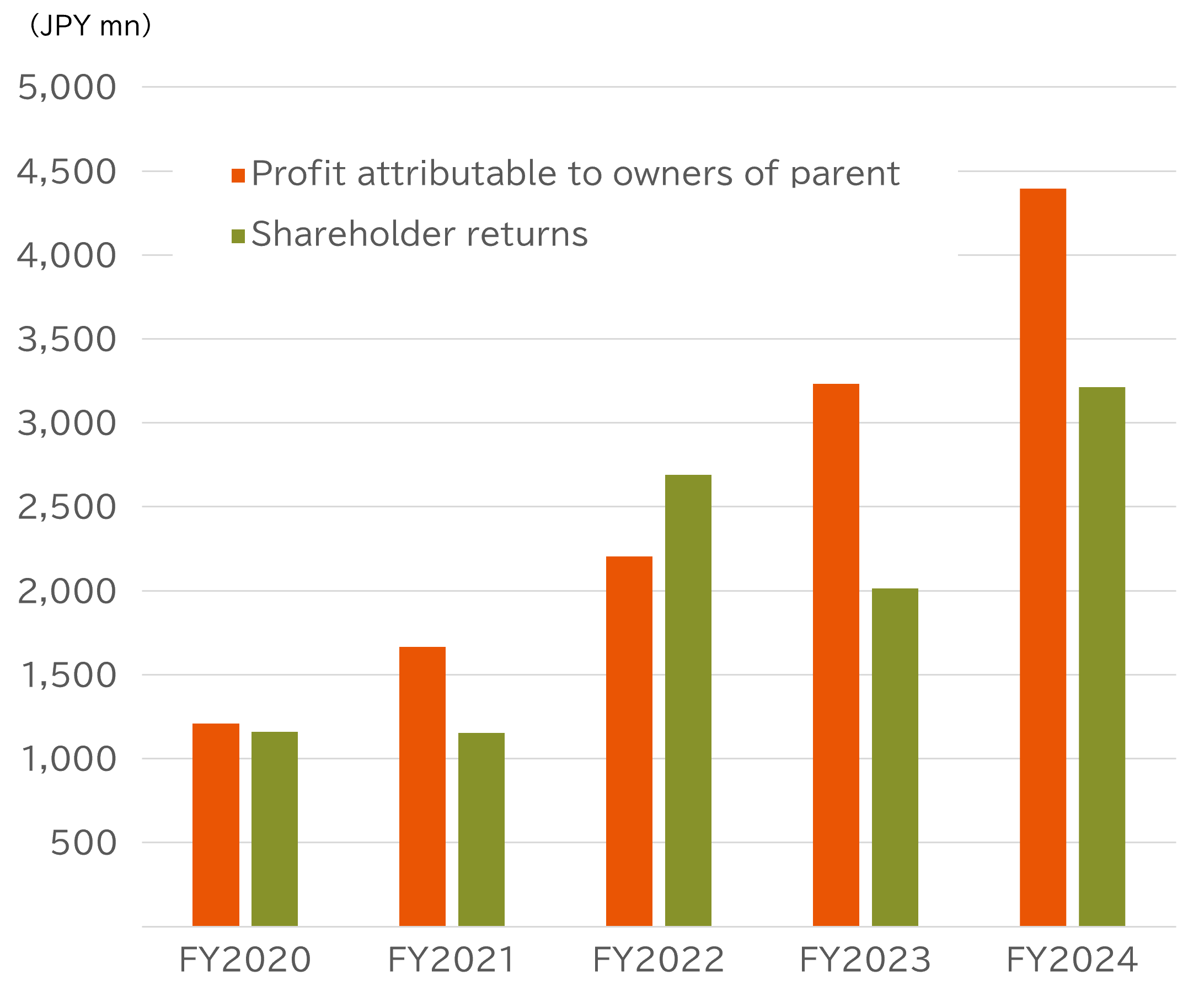

Shareholder returns will be provided through stable dividends and share buybacks.

Note : Shareholder return: Dividends + share buybacks (includes additional contributions to stock compensation trust)

- We will carry out shareholder returns linked with business performance, and endeavor to maintain stable dividend payments.

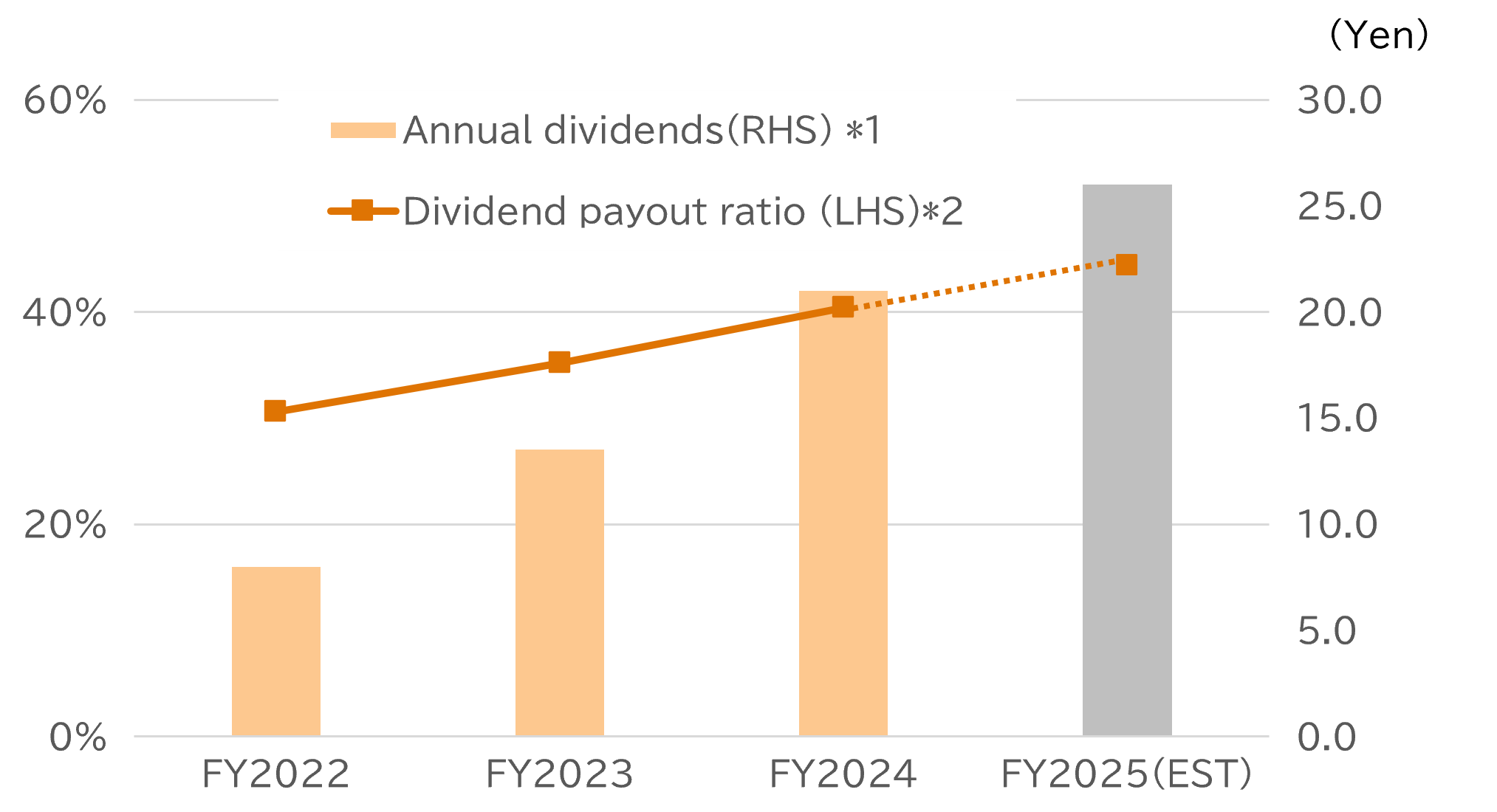

- We have set a new target for the dividend payout ratio and will raise it to 50% by FY29.

|

FY24 |

FY25 forecast |

YoY change |

|

|

Annual dividend per share |

21 yen |

26 yen |

+5yen |

The Company carried out a 2-for-1 stock split for its common shares, effective December 1, 2024. The chart at right shows the annual dividend amount, assuming that the stock split had been conducted at the beginning of FY22.

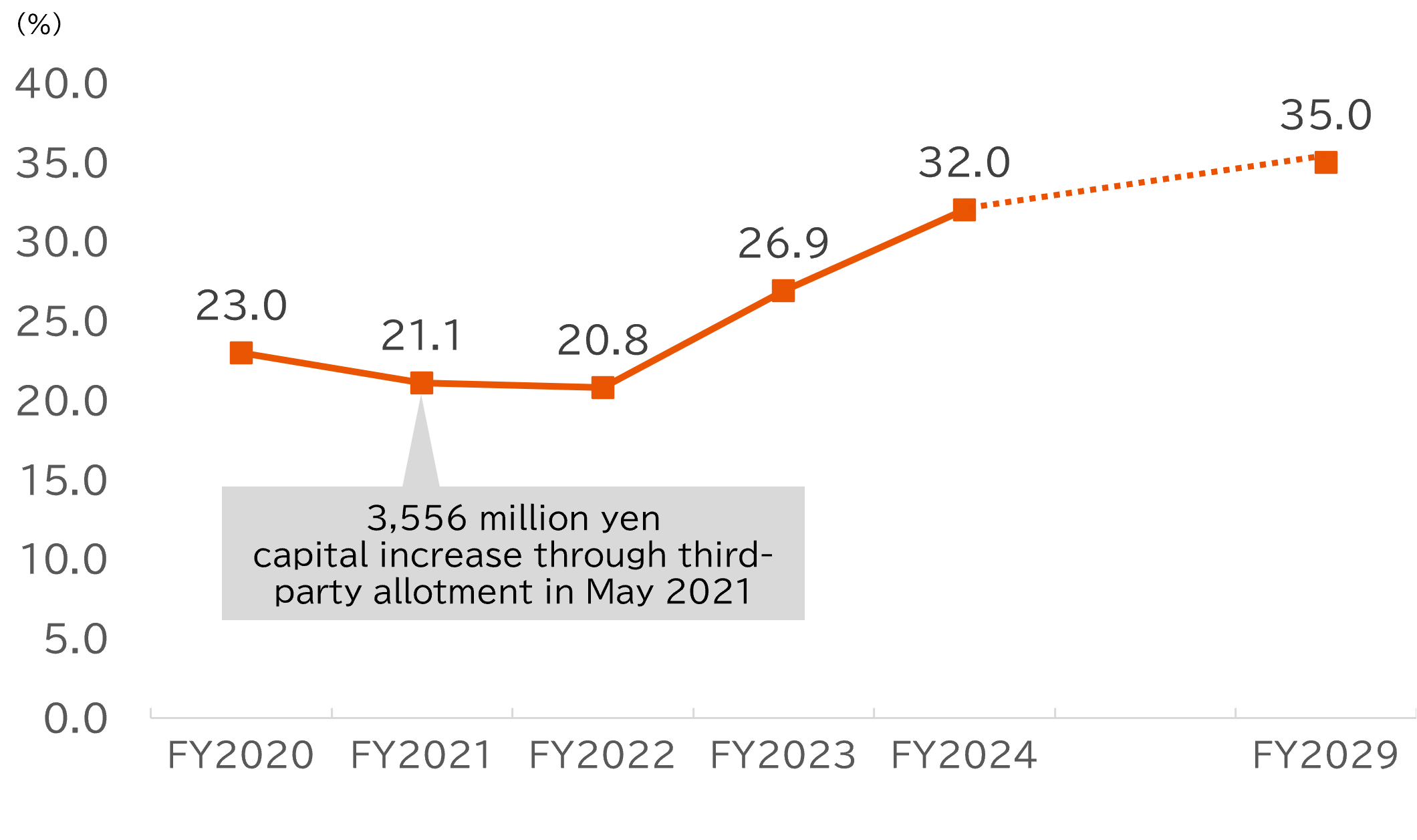

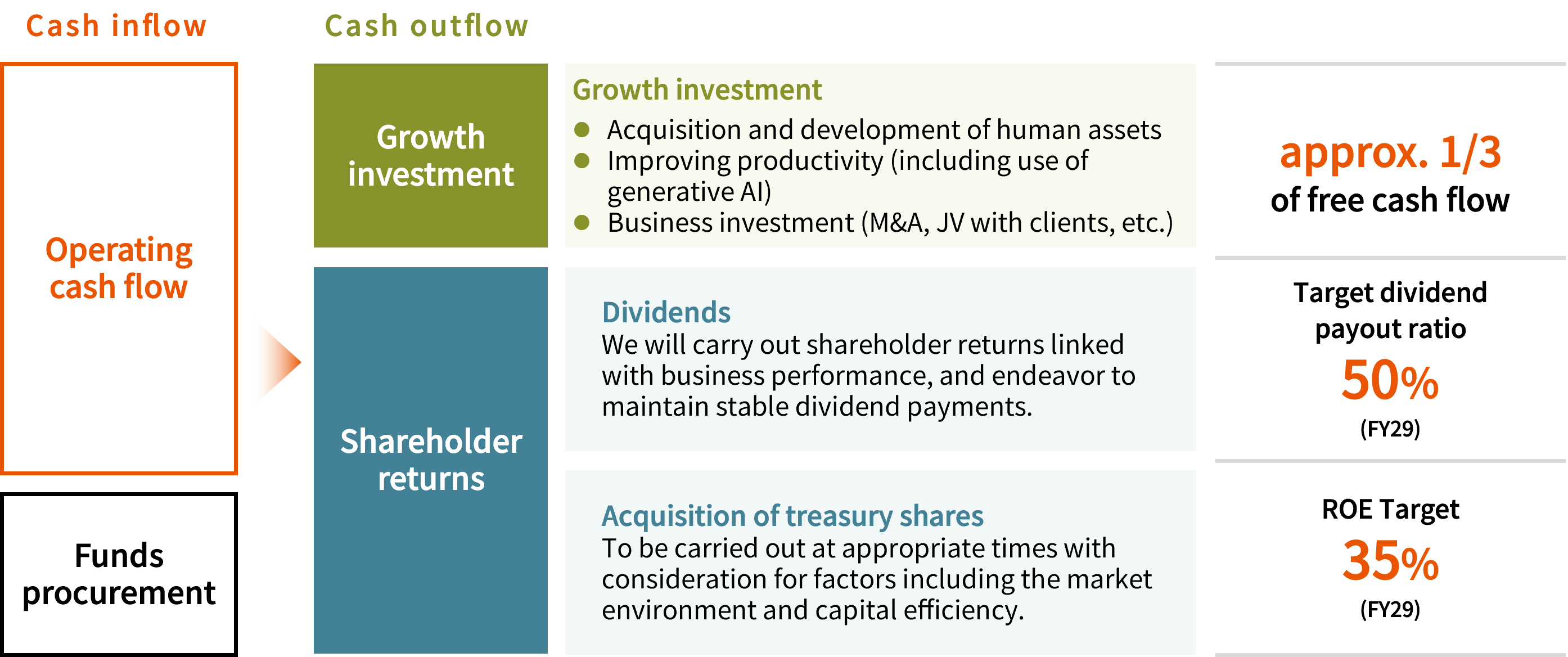

The Company's Board of Directors recognizes ROE as an important management indicator of return on capital and aims to raise it to 35% by FY29.

- Revenue expansion and profit growth through the realization of growth strategies.

- Control the level of equity capital through strategic returns to shareholders.